Optimizing Customer Acquisition Funnel

Transformed a major European bank's customer acquisition funnel by applying cognitive load reduction and mono-tasking principles, resulting in significantly improved conversion rates and reduced user abandonment.

Adapted

2025

Banking

175 million

200,000+

Challenge

A major European financial institution was experiencing significant user drop-off rates across their digital onboarding processes, with some critical steps showing abandonment rates exceeding 80%. The challenge wasn't just technical: it was fundamentally psychological

Results

Through 64+ systematic behavioral experiments across 6 product lines, I achieved conversion uplifts ranging from 1.38% to 6.51% with 99%+ statistical confidence on customer acquisition. The key breakthrough was discovering that optimal cognitive load varies dramatically by context: simple products needed minimal friction while complex financial decisions actually improved with consolidated information flows. This behavioral psychology framework was adopted organization-wide, transforming their approach from feature-driven to psychology-driven design across all digital touchpoints.

6.51%

Uplift

99%

Statistical confidance

The Scope

88.9% abandonment rates at critical conversion points

Multiple product lines experiencing user drop-off (everyday banking, credit applications, business solutions, investment services)

Complex user journeys requiring sensitive personal and financial information

High-stakes decisions where users felt vulnerable sharing data

The Behavioral Complexity

The real challenge was that one-size-fits-all optimization doesn't work in financial services. Users approaching different products had vastly different:

Cognitive loads (simple account opening vs. complex credit decisions)

Risk perceptions (routine banking vs. investment planning)

Motivation levels (urgent needs vs. exploratory browsing)

Expertise levels (consumer vs. business banking)

Trust requirements (basic transactions vs. major financial commitments)

Process

Phase 1: Behavioral Diagnosis

Mapped emotional user states to specific interaction moments and analyzed abandonment patterns through a behavioral psychology lens. The breakthrough insight: "Less isn't always more": optimal cognitive load depends entirely on decision context, user motivation, and perceived risk.

Phase 2: Framework Creation

Developed the Context-Cognitive Matrix, a systematic approach for determining optimal UX strategy based on decision stakes and complexity. Created four distinct strategies: Information Rich (high stakes + complexity), Cognitive Minimal (low stakes + simplicity), Trust Focused (high stakes + simplicity), and Progressive Disclosure (low stakes + complexity).

Phase 3: Multi-Product Experimentation

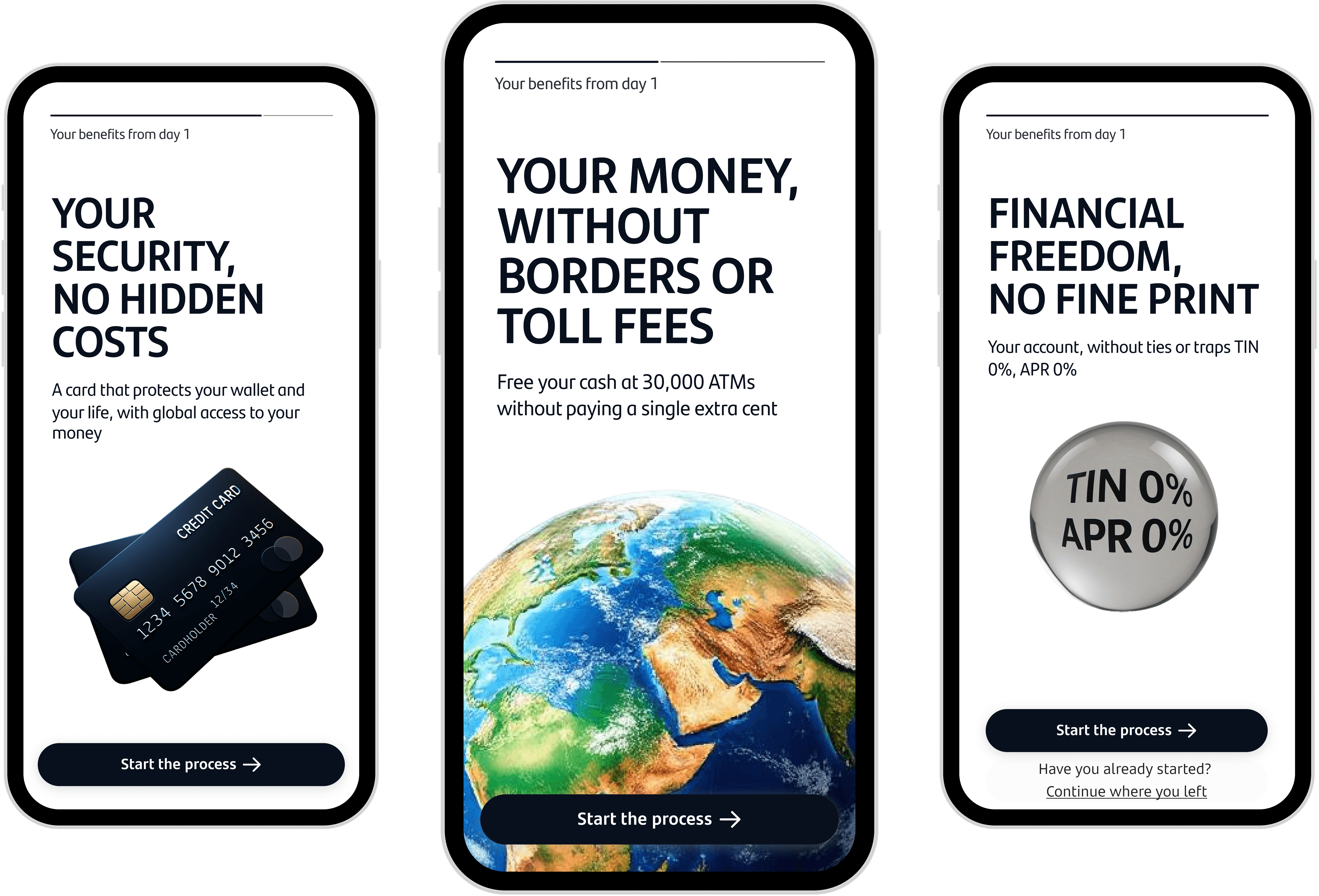

Applied different behavioral strategies across product lines: monotask methodology for everyday banking (6.51% uplift), flow consolidation for credit products (8.37% uplift), and adapted approaches for business banking contexts. Each test was grounded in specific psychological principles like cognitive load theory and progressive momentum.

Phase 4: Advanced Implementation

Refined psychological timing optimization including the Trust-Timing Principle (security messaging when users felt vulnerable) and Value-Effort Balance (higher cognitive load acceptance when value was clear). Built sophisticated analytics tracking behavioral indicators, cognitive load metrics, and emotional comfort signals.

Phase 5: Organizational Integration

Systematized the behavioral framework into reusable methodologies and established psychology-driven design principles. Created comprehensive testing infrastructure supporting multi-variate psychological experiments and real-time behavioral adaptation across all digital touchpoints.

Conclusion

This project fundamentally challenged the assumption that "simple is always better" in digital design. By applying behavioral psychology systematically across multiple product contexts, I discovered that optimal user experience requires deep understanding of decision psychology: not just interface design.

The Context-Cognitive Matrix framework now serves as a strategic tool for financial product development, proving that when we design for human psychology rather than generic UX principles, we can achieve both superior user experiences and measurable business impact. This approach transforms how organizations think about digital optimization: from feature-driven iterations to psychology-driven systematic improvements.

Most importantly, this work demonstrates that behavioral science can be operationalized at scale: turning psychological insights into repeatable methodologies that drive consistent results across diverse product lines and user contexts.